Le taux de change professionnel pour les entreprises

Le taux de change professionnel pour les entreprises

Vous êtes une entreprise et vous achetez des marchandises en Europe, vous importez des produits d’Asie ou vos clients vous paient dans une autre monnaie que la vôtre ?

Telexoo peut vous accompagner dans vos transactions à l’international en simplifiant la gestion des paiements et en vous faisant bénéficier de taux de change bien plus compétitifs que les acteurs traditionnels.

Besoin de payer une facture ? Appelez-nous pour bloquer le taux de change.

Vous avez des salariés frontaliers ? Payez les salaires directement en EUR.

-

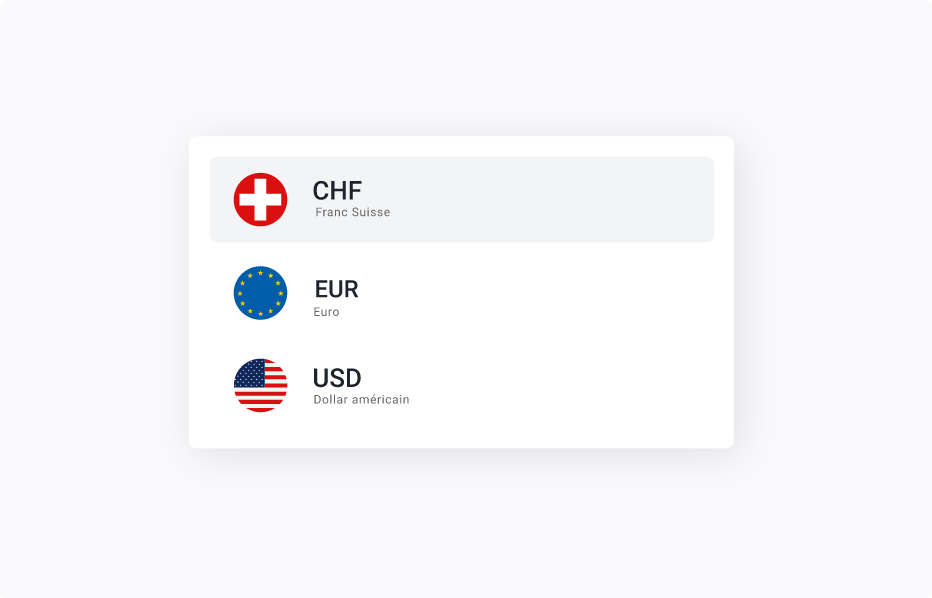

CHF

Franc Suisse

-

EUR

Euro

-

USD

Dollar

-

GBP

Livre Sterling

-

CAD

Dollar Canadien

-

AED

Dirham Emirats Arabes

-

AUD

Dollar Australien

-

CZK

Couronne Tchèque

-

DKK

Couronne Danoise

-

HKD

Dollar de Hong Kong

-

HUF

Forints Hongrois

-

JPY

Yen Japonais

-

NOK

Couronne Norvégienne

-

NZD

Dollar Néo-Zélandais

-

PLN

Zloty Polonais

-

SEK

Couronne Suédoise

-

SGD

Dollar de Singapour

-

ZAR

Rand Sud-Africain

-

CHF

Franc Suisse

-

EUR

Euro

-

USD

Dollar

-

GBP

Livre Sterling

-

CAD

Dollar Canadien

-

AED

Dirham Emirats Arabes

-

AUD

Dollar Australien

-

CZK

Couronne Tchèque

-

DKK

Couronne Danoise

-

HKD

Dollar de Hong Kong

-

HUF

Forints Hongrois

-

JPY

Yen Japonais

-

NOK

Couronne Norvégienne

-

NZD

Dollar Néo-Zélandais

-

PLN

Zloty Polonais

-

SEK

Couronne Suédoise

-

SGD

Dollar de Singapour

-

ZAR

Rand Sud-Africain

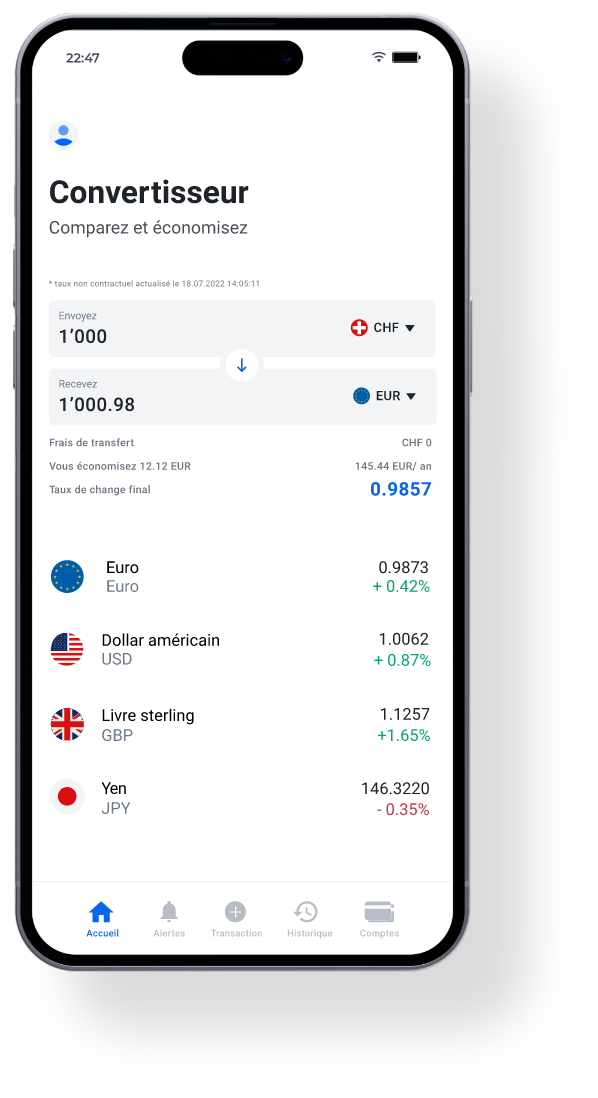

Comment effectuer votre change avec Telexoo ?

Créez un compte gratuit en quelques minutes

Créez un compte Telexoo en renseignant vos comptes bancaire source et destination pour que Telexoo puisse traiter vos opérations de change.

Transférez le montant à changer

Faites un virement du montant que vous souhaitez changer vers le compte bancaire de Telexoo correspondant à la devise que vous envoyez.

Profitez du change à des taux préférentiels

Dès réception de votre virement, nous effectuons le change en utilisant le taux interbancaire et notre marge préférentielle.

Recevez votre change entre le jour même et 48 heures

Nous virons les fonds sur votre compte bénéficiaire. Le transfert prend généralement entre le jour même et 48 heures, selon la monnaie et le pays concernés.

How Telexoo can save you money through exchange rates

For each payment in foreign currency or via a foreign transaction, banks take what is called in the financial jargon a “spread”, which actually is a margin expressed either in percent or in Pip (percentage in point). The higher this margin is, the less competitive is the exchange rate that the bank grants you.

These margins will be more or less important depending on the amount that you send and the desired currency.

In fact, banks exchange currencies among themselves at interbank rates, which is the market rate that you can follow on the main economic and financial websites. However, when a corporate or private customer needs to buy or sell a currency, banks will apply a margin or a commission.

These margins can be very expensive. For instance, if you are an event planning company and you want to pay a bill for the organization of a golf course in Morocco in Moroccan dirham, traditional banks will apply a margin of 5% on the interbank exchange rate. Telexoo allows to reduce this margin by 80%.

These margins can also have severe consequences if, for example, you have a company that processes large annual volumes of very common currencies such as EUR, USD, GBP but which are cut into multiple monthly transactions. In that case the bank will not consider your annual volume of business to calculate its margin, but it will instead apply the spread corresponding to the amount of your transaction.

It seems quite unfair when you have an annual payment volume in hundreds of thousands, or even in millions, and the bank applies its maximum margin because you pay a bill of 10'000 euros.

Due to the large volume of exchange processed and to its specialization as the main exchange player in Switzerland, Telexoo reduces for you this margin by 50 - 80% while taking into account both amounts and currencies.

Fast currency exchange service

Performing a foreign exchange and a transfer transaction with Telexoo is very fast.

An operation can be carried out the same day, which is very useful if you need to quickly receive the converted amount. The transfer will take up to 48h depending on the currency and country of destination.

How Telexoo works ?

For the sake of speed and security, we work via bank transfers. Our customers make a transfer of the amount that they wish to convert to Telexoo IBANs, upon receipt we convert it into the required currency and then transfer it to the recipient of your choice.

You decide when to change

One of the greatest advantages of our service in comparison to traditional banks is that you can have control over the exchange rate. Indeed, when you generate a payment in a currency via ebanking, banks give you the rate once the transaction has been completed, so you have no control over the rate.

With Telexoo, you will be able to follow our rate and to contact us when it suits you to set it. No more surprises, you benefit from perfect transparency.

Managing payments in foreign currencies

You need flexibility, we adapt to your process. The management of foreign currency needs to be simplified to save you time.

When you convert any amount with Telexoo, we offer you to send the converted currency either to your beneficiary's account(s) or directly to your own account, if you have one in the required currency.

You can hedge your currency risk

You will have to pay a bill in a few months or you see the currency you are trading at advantageous levels, Telexoo assists you with foreign exchange instrument and hedging strategies at unbeatable rates.

Your company buys in euros but sells in Swiss francs, your customers pay you in arrears while you pay your suppliers quickly. Do not take any more risk on the evolution of the exchange rate euro - Swiss franc. We have a lot of experience and will be happy to share it with you.

Security

Hundreds of SMEs deal with Telexoo for more than thirty different currencies. We have implemented very high security procedures and our own funds are well above the required standard. Telexoo is a financial intermediary authorized by the Regulatory Authority of Geneva (So-Fit).

SO-FIT est un organisme d’autorégulation reconnu par l’Autorité fédérale suisse de surveillance des marchés financiers (FINMA).